"Dru" (therealkennyd)

"Dru" (therealkennyd)

02/26/2019 at 14:09 ē Filed to: None

0

0

66

66

"Dru" (therealkennyd)

"Dru" (therealkennyd)

02/26/2019 at 14:09 ē Filed to: None |  0 0

|  66 66 |

Anyone else?

Iíve been making regular payments on my student loans for 6 years. Or maybe itís 7. No wait itís got to be closer to 38.

I took the ride, so I have no problem paying for my ticket. But it has become super discouraging to have so many payments behind me, and yet so many ahead of me.

So, are your student loans a burden to you?

CarsofFortLangley - Oppo Forever

> Dru

CarsofFortLangley - Oppo Forever

> Dru

02/26/2019 at 14:18 |

|

Is unending for me because my wife refuses to stop going to school.

HOW MANY DEGREES DO YOU NEED WOMAN!!!

#triggered†

Dru

> CarsofFortLangley - Oppo Forever

Dru

> CarsofFortLangley - Oppo Forever

02/26/2019 at 14:20 |

|

Oof.† My condolences.†

Brickman

> Dru

Brickman

> Dru

02/26/2019 at 14:20 |

|

nah, I ignored my high school counselor and stuck to turning wrenches and becoming an oily greasy mess.

Poor if you go to college, poor if you donít. At least I have less bills :)

Azrek

> Dru

Azrek

> Dru

02/26/2019 at 14:21 |

|

I paid for 2 years of college up front when I was in my teens...realized this was dumb and never did that again. GIBill pays ME to goto College and my company also gives me a stipend. So Iíve gotten 3 degrees and will finish 2 more come Summer with a 6th not far off.

Yeah, I suck....sorry...

RutRut

> Dru

RutRut

> Dru

02/26/2019 at 14:21 |

|

I just make my payment and not really think about it at this point. 15 year repayment plan is just chugging along in the background.†

CarsofFortLangley - Oppo Forever

> Dru

CarsofFortLangley - Oppo Forever

> Dru

02/26/2019 at 14:22 |

|

I just measure her tuition in cars. How much this year? A P71? Damn... I really wanted one of those.

Ash78, voting early and often

> Dru

Ash78, voting early and often

> Dru

02/26/2019 at 14:22 |

|

Iím fortunate to have finished undergrad in 2000, back when a full year (in state) at most state schools was just a few thousand dollars. I cannot freaking believe how expensive it is now. For comparison, we pay more for my son to go to a non-profit church-sponsored elementary school now than I paid for college tuition.

I got 99

problems, but Sally Mae ainít one.

Dru

> Brickman

Dru

> Brickman

02/26/2019 at 14:22 |

|

This is a correct take. I often wonder if public schoolsí funding is low key tied to number of seniors admitted to 4 year unis. †

Dru

> Azrek

Dru

> Azrek

02/26/2019 at 14:23 |

|

Hey you had the foresight to find other folks to pay your way.

jimz

> Dru

jimz

> Dru

02/26/2019 at 14:25 |

|

Iím very fortunate that I went to school before tuition rates exploded.† If I was entering university today, I would not be able to afford to go to the school I went to.† their tuition has increased at about 3x the rate of inflation.††

JeepJeremy

> Dru

JeepJeremy

> Dru

02/26/2019 at 14:27 |

|

I donít understand whatís going on in this country. An entire generation of people were encouraged to better themselves through advanced education...and then weíve all been enslaved to student debt. It was like a long con to turn a huge portion of our society into wage slaves. I graduated in 1999. I have a degree. Of the 200+ I graduated high school with...I know of about 2 to 4 that have actually benefited from getting a college degree. The rest of use wouldíve been much better off not going. It didnít give the payoff that we were promised. Instead weíre all financially handicapped.

And then you hear about our govt giving out billion dollar aid packages? Where does that money go? Who benefits from it?

Why donít we put a multi billion dollar aid packaged together for college graduates here in the US? Where would all that money go? BACK INTO OUR ECONOMY. Maybe some of us would actually be able to buy a new car? Or a new home? Or actually pay for our healthcare? Or actually SPEND money.

Iím not an economist. I do not know anything about the finer points of all of this. But money isnít even REAL. Our citizens are real. We owe something fake to an institution we prop up through fallacy.

Itís a crime against

our

humanity.

shop-teacher

> Dru

shop-teacher

> Dru

02/26/2019 at 14:28 |

|

Iím 13 years into paying them, with two more to go. Mine are more annoying than they are a burden . I was fortunate that I went to school in a time when a good state university was still reasonably affordable, and I also had a fair bit of help from family. As such, I left graduate school with about $12k in debt, and at something like 2.5% interest. Theyíre not even worth paying off early, I think I paid $6 8 or something like that in interest last year.

MasterMario - Keeper of the V8s

> Dru

MasterMario - Keeper of the V8s

> Dru

02/26/2019 at 14:30 |

|

I was lucky, m y parents paid for half my tuition. The other half I managed to pay for myself by working throughout college. I graduated with no student loans. This was only possible by going to an in state public university, but thatís part of the reason I chose that one .

smobgirl

> Dru

smobgirl

> Dru

02/26/2019 at 14:31 |

|

I couldnít qualify for real student loans because my parents are jerks. Everything I couldnít pay with my restaurant job (thankfully not TOO much)† went on a crappy credit card, which took me ten years to pay off since it was a 24% APR. That was great to have hanging over my head but Iím good now.†

davesaddiction @ opposite-lock.com

> Dru

davesaddiction @ opposite-lock.com

> Dru

02/26/2019 at 14:32 |

|

Sorry to hear it. I was fortunate. I took out loans for all of my college expenses , but I went in-state and it wasnít terribly expensive at the time (20 years ago). I had a job all through college that took care of some expenses - s eems like my total was just like $30k at the end , and at a crazy low interest rate. Eventually got a good job; theyíve been paid off for some time.

BeaterGT

> Dru

BeaterGT

> Dru

02/26/2019 at 14:33 |

|

Regular payments is whatís killing you because interest accrues daily. Try messing with your payment schedule to double up payments or have some payments go straight to principal.

Also check to see if your loan provider offers an interest rate discount for signing up for automatic payments. Itís usually only a quarter of a percent but every bit helps and is certainly worth the effort. Let me know if any of this doesn't make sense, I'm glad to help.†

gogmorgo - rowing gears in a Grand Cherokee

> Dru

gogmorgo - rowing gears in a Grand Cherokee

> Dru

02/26/2019 at 14:39 |

|

Mine are manageable, but still I dream about the stuff Iíd be able to do with all the extra cash. Iím five years in with about eight left... I think. But I also didnít finish my† degree so that burns a bit.

Dru

> davesaddiction @ opposite-lock.com

Dru

> davesaddiction @ opposite-lock.com

02/26/2019 at 14:41 |

|

Itís no big deal, really.† I looked into upping my payments so pay it off sooner, but it would only have saved me like $400 over several years.

Dru

> BeaterGT

Dru

> BeaterGT

02/26/2019 at 14:42 |

|

Thanks for the input.† I actually did sign up for auto payment a while back, so theyíve been chipped away at.† I think Iím at maybe 1/3 of the original balance.† The end is near, it just doesnít feel like it is.

Spamfeller Loves Nazi Clicks

> CarsofFortLangley - Oppo Forever

Spamfeller Loves Nazi Clicks

> CarsofFortLangley - Oppo Forever

02/26/2019 at 14:42 |

|

At least she doesnít attend Baldwin Wallace.

P71? You wish.

Thatís a Ram 1500.

2019. Just about fully loaded.

PER YEAR.

davesaddiction @ opposite-lock.com

> Dru

davesaddiction @ opposite-lock.com

> Dru

02/26/2019 at 14:44 |

|

Glad itís no huge burden. All debt does feel like an anchor at times , though.

CarsofFortLangley - Oppo Forever

> Spamfeller Loves Nazi Clicks

CarsofFortLangley - Oppo Forever

> Spamfeller Loves Nazi Clicks

02/26/2019 at 14:46 |

|

yeah, luckily school is cheaper in Canada and she does get some rewards.

BeaterGT

> Dru

BeaterGT

> Dru

02/26/2019 at 14:46 |

|

No problem, here to help. Got a few of my friends out of bad spots with their loans where none of their payment was actually paying down the loan. Itís the least I can do with my finance degree!

SPAMBot - Horse Doctor

> Dru

SPAMBot - Horse Doctor

> Dru

02/26/2019 at 14:55 |

|

I started paying mine Jan. 2013 and if everything goes to plan this year, they will be paid off by Dec 31st, 2019. Mine were not tooo bad. I had academic and athletic scholarships that essentially covered 75% of my ďall-inĒ expenses (Tuition, books, living quarters, incidentals, etc.). Still though, Iíve been making what would have been a decent car payment for what will be 7 years. I havenít been in a crazy rush to pay them off because they are all subsidized with a ďlowĒ interest rate. Plus I can defer them if I lose my job. Since itís pretty ďsafeĒ debt, and doesnít have a asset tied to it, Iíve prioritized paying it off last.

Still though, because I had loans, I feel like Iíve had to take fewer risks after graduation. I never felt like I could go work for a low paying or unstable startup (in the hopes the made it big and had a large payoff later). In part because I knew I had this big debt over my head. If shit would have hit the fan in the first year of my career, it would have been financially disastrous.

Spanfeller is a twat

> BeaterGT

Spanfeller is a twat

> BeaterGT

02/26/2019 at 14:59 |

|

I thought student loans were interest free.†

Spanfeller is a twat

> Dru

Spanfeller is a twat

> Dru

02/26/2019 at 15:00 |

|

College in the US sounds like a horrible experience...

nermal

> Dru

nermal

> Dru

02/26/2019 at 15:01 |

|

My degree was fully paid for within 2 years of finishing, with no help from anybody else (thanks for nothing mom & dad... and government... and everybody else for that matter.... ).

There are people that I went to school with that will be paying off student loans until they are 40. I couldnít imagine that.†

TheRealBicycleBuck

> Dru

TheRealBicycleBuck

> Dru

02/26/2019 at 15:01 |

|

As the sole provider for our family, I am currently paying for six degrees - three for me, three for my wife. Iíll be paying on them until I retire. Fortunately, the only other debt we have is my car payment and the mortgage. Iím looking forward to my wife† going back to work. Weíre about to start putting kids in college.

Neil drives a beetle and a fancy beetle

> Dru

Neil drives a beetle and a fancy beetle

> Dru

02/26/2019 at 15:01 |

|

I graduated law school in 2012 and worked in public service for a little over 4 years making small IBR payments thinking Iíd eventually get Public service forgiveness and watched my interest grow . Life changed and now Iím in the private realm so no more hopes of PSLF and Iím at a a point where I am probably going to make minimum IBR payments for 18 more years and then pay the taxes on the ďincomeĒ when itís forgiven .

My biggest regret in life will likely be not having a better grasp on student loans and total cost of my education before going to law school. But Iím fairly accepting of it. I had it in my head to try to refinance with a private lender as watching my loan not get paid down meaningfully is sad but I canít get a decent rate and Iíd be paying a lot more with a refinance than IBR for the next 7 years. After that it would be cheaper most likely but it also pins me into not having the flexibility that IBR offers. And refinancing with the rates Iím getting is a break even proposition over the long haul(even with the tax hit from forgiveness)† sooooo...

BeaterGT

> Spanfeller is a twat

BeaterGT

> Spanfeller is a twat

02/26/2019 at 15:07 |

|

Maybe in the sense that we have 0 interest in them :)

Perhaps youíre thinking of subsidized versus unsubsidized? Even still, some students/families take private student loans from the big banks which usually carry a higher interest rate.

TheRealBicycleBuck

> Spanfeller is a twat

TheRealBicycleBuck

> Spanfeller is a twat

02/26/2019 at 15:07 |

|

You thought wrong. Worst part is that you canít refinance federally subsidized loans, so my peers and I are stuck at 7% interest or higher.†

Spanfeller is a twat

> TheRealBicycleBuck

Spanfeller is a twat

> TheRealBicycleBuck

02/26/2019 at 15:08 |

|

Jesus fucking christ thats insane.†

Spanfeller is a twat

> BeaterGT

Spanfeller is a twat

> BeaterGT

02/26/2019 at 15:09 |

|

The federally backed ones so I think subsided?†

Spanfeller is a twat

> Spamfeller Loves Nazi Clicks

Spanfeller is a twat

> Spamfeller Loves Nazi Clicks

02/26/2019 at 15:14 |

|

50-70

k a year?

My entire education is gonna cost the low end of

that.... and it would cost 20 cents if I was smart enough to attend a public one.

Party-vi

> Dru

Party-vi

> Dru

02/26/2019 at 15:15 |

|

My wife and I just paid her student loan off, but that was with some help from her parents, the thought process being ďyouíve done so well with your money that weíll give you more moneyĒ. I...still donít understand how that thinking works but I wonít question it!

Chariotoflove

> Dru

Chariotoflove

> Dru

02/26/2019 at 15:16 |

|

I am truly blessed with parents who were able and willing to pay for my college so that I have no debt.

My wife had to take out loans, and they were in the 80s, when interest rates were above 9%. †I gave her a reverse dowry when we got married and paid them off. †Thatís one of the small consolations of the settlement that came out of my injury lawsuit.

farscythe - makin da cawfee!

> Dru

farscythe - makin da cawfee!

> Dru

02/26/2019 at 15:18 |

|

nope

i dont have any...

my lack of education is a burden to me finding a job that doesnt consider me a disposable work force tho

(slowly getting easier to land jobs that arent competely at the bottom of the ladder as ive aquired some certs n diplomas over the years.... but its still i a shit)

BeaterGT

> Spanfeller is a twat

BeaterGT

> Spanfeller is a twat

02/26/2019 at 15:19 |

|

Both are federally backed, only difference being how the interest is handled but they both have an interest portion unfortunately. This is why students who are able to get jobs/internships in college and can start repaying right away are in a much better position.

Meanwhile, some students have to get placeholder jobs and sell their old Z28 to buy a Saturn... that didnít last long.

Spamfeller Loves Nazi Clicks

> Spanfeller is a twat

Spamfeller Loves Nazi Clicks

> Spanfeller is a twat

02/26/2019 at 15:20 |

|

I said nearly fully loaded.

So yes - $50k. No, I am not joking. That is the typical cost for a private college in the US. This is why it is such a scam and why they have made it so that your student loan debt survives your death . Not joking.

JCU, ~$50-55k/year not including your course materials.

BGSU out of state, $35k/year not all inclusive

CWRU, ~$55k/year not including your course materials.

CSU out of state, undergrad, $20k/year. And thatís a

PUBLIC

.

Spanfeller is a twat

> Spamfeller Loves Nazi Clicks

Spanfeller is a twat

> Spamfeller Loves Nazi Clicks

02/26/2019 at 15:26 |

|

How are those so expensive? I mean, I go to a private, non profit college, and my five year course is 50k give or take.

Iím gonna do some top gear maths,

US GDP/MX GDP *50k= 156,394

Iím using PPP, not Nominal.

So, even adjusted for costs of living, college here is significantly cheaper.

Dru

> Spanfeller is a twat

Dru

> Spanfeller is a twat

02/26/2019 at 15:38 |

|

The experience is fine. Funding it can often be a nightmare.† Iím planning on starting a 529 for my daughter before too long.

Spanfeller is a twat

> BeaterGT

Spanfeller is a twat

> BeaterGT

02/26/2019 at 15:38 |

|

Its very much a luck thing... why its so expensive is beyond my grasp

Dru

> nermal

Dru

> nermal

02/26/2019 at 15:39 |

|

Ooooooffff.† Well good onya for knocking out that debt.† At the current rate I am set to have mine paid off late in 2021.† Iíll be 33.†

Spamfeller Loves Nazi Clicks

> Spanfeller is a twat

Spamfeller Loves Nazi Clicks

> Spanfeller is a twat

02/26/2019 at 15:44 |

|

Because this is how the US works, like it or not. People spend all their time just straight up lying to themselves about it. Like saying ďwell thatís not what you pay, because scholarships! GI Bill!

The US made a decision collectively to make getting an education a punitive punishment, in other words. Thereís a whole variety of things that go into it, like OSU (public university, tuition: $35,000+/yr) paying their football coach more than $25M over the next 5 years including $1200/mo for a car, a private jet for personal use, and so on.

But the fact is attempting to get an education in the US is guaranteed to wreck you financially for the rest of your life. Any time someone finds an escape, they wall it off. Student loans canít be discharged in bankruptcy, they can garnish your wages forever, they can charge any interest rate they want, and of course, youíre never getting one without a co-signer.

Way way back when I would have been looking at enrollment, getting a decent CompSci degree at a program that wasnít 10+ years behind would have cost more than $250,000. And that wasnít even MIT. MIT currently will cost you more than $75,000 per 9 months ($50k tuition, $25k in Ďmiscellaneousí expenses they deliberately understate.)†

And thatís just the way the powers that be like it.

BeaterGT

> Spanfeller is a twat

BeaterGT

> Spanfeller is a twat

02/26/2019 at 15:51 |

|

Yeah, thatís a whole other can of worms.† I often joke the only thing I really learned from getting a finance degree was how much my university was screwing me financially.

BigBlock440

> Dru

BigBlock440

> Dru

02/26/2019 at 16:16 |

|

Nah, I worked through college for spending money and books, and as much room and board as I could, only taking loans on what I needed to.† Ended up with around $30k when I graduated.† I always paid extra, mostly because I like even numbers and I rounded up to the nearest $10. As I got raises, I put most of my extra income into paying the highest interest rates first, now Iím down to the less than $10k with some of them completely done and an end in sight.

Khalbali

> Dru

Khalbali

> Dru

02/26/2019 at 16:46 |

|

Yes. For literally the rest of my life most likely. I'm pretty sure I owe more now than I borrowed and I've been making payments for over 5 years at least, probably closer to 7.

SilentButNotReallyDeadly...killed by G/O Media

> Dru

SilentButNotReallyDeadly...killed by G/O Media

> Dru

02/26/2019 at 17:08 |

|

No... because, at the time in Oz, university was Ďfreeí until my last year when the Higher Education Contribution Scheme (HECS) was launched . And the bill for that year didnít add up to much.

HECS basically means that the government pays your uni bill and then you pay the government back over time through your tax bill once your taxable income exceeds a certain threshold. As with all income taxes here in Oz, you can make voluntary quarterly contributions up front and pay down the HECS debt (which does accrue interest) faster.

But this is also why we have created an education fund for the Lad...

ZHP Sparky, the 5th

> JeepJeremy

ZHP Sparky, the 5th

> JeepJeremy

02/26/2019 at 17:09 |

|

A lot I can agree with there. Lately Iíve been thinking a lot about all the various breaks given to huge corporations. I work for one Ė we get all kinds of crazy tax breaks, incentives, grants, etc. being one of the largest corporations in the world. The theory is that enticing such a company to a state/county, or giving them aid at the federal level is good for the economy Ė it keeps people employed, and has the ability to create a good income tax base. You now what else would do that? Using that money instead to lift up people directly Ė programs to fund education and healthcare for individuals. That will improve productivity and standard of living for people across the board, fixing a lot of the income inequality issues weíve created as a society too.

Iím just sick of any kind of corporate perks being looked at

as good business policy (ahem, tax reform!) but even the mere suggestion of

using those same funds to benefit people directly instead and weíre all

shouting SOCIALISM!!!

As for aid packages Ė yup thereís a lot of foreign aid we should think long and hard about (ahem, Israel) although there are many truly destitute places in the world that do need the help, and does help maintain a certain level of global normalcy too without letting things go too far south and fall prey to extremist ideologies and whatnot.

ZHP Sparky, the 5th

> Dru

ZHP Sparky, the 5th

> Dru

02/26/2019 at 17:25 |

|

Iím very thankful to not have any student loan debt of my own thanks to my parents help and their employers helping pay for some of my education. We do have over $40k of student loans from my wifeís undergrad and graduate school though Ė that was after significant scholarships she received. I canít imagine what being a family with 2 peoplesí student loans to pay off would be like.

My wife has worked for organizations that would qualify for

federal student loan forgiveness programs Ė but as you may have seen over 99%

of people who had applied to have their loans forgiven were rejected. We didnít

even bother trying after realizing that we had been repaying TOO MUCH to have

qualified for the rest to be forgiven. WTF? Theyíre mad that theyíll have to

forgive too little? Its infuriating.

Having a newborn at home Iím hell bent on starting a 529 or some kind of college savings plan for her ASAP. Who knows how much education will cost in 18 years. The whole system is fucked Ė we either have people terribly in debt, or people who canít afford to get an education in the first place. Agreed that trade schools and other forms of employment should be encouraged but as a society there are some significant structural issues that need to be dealt with soon before people start sharpening up their guillotines.

Pickup_man

> Dru

Pickup_man

> Dru

02/26/2019 at 17:46 |

|

Iíve been paying double to triple my required amount and should have them paid off by this summer, so slightly less than five years in total . Thatís for 3/5 years worth of schooling while †working close to 30 hours a week so I could keep my loans at a minimum. My wife on the other hand didnít have the luxury of being able to work through school, didnít really get any help, and had to take loans to cover 4 years worth of school, plus living expenses. Weíll probably be paying hers for the full 10 years unfortunately . Weíll probably up the payments on hers once Iím finished, but weíre also trying to buy an acreage in the next few years and have to prioritize strategically to make dreams happen, yet pay off debt in a timely manner.†

Spanfeller is a twat

> Spamfeller Loves Nazi Clicks

Spanfeller is a twat

> Spamfeller Loves Nazi Clicks

02/26/2019 at 17:52 |

|

Who knows why college in the US is so expensive.

TheRealBicycleBuck

> Spanfeller is a twat

TheRealBicycleBuck

> Spanfeller is a twat

02/26/2019 at 17:54 |

|

The bulk of a universityís budget, nearly 50%, is tied up in personnel costs. This includes direct salaries and benefits. A lot of it does go to the professors, but they really arenít making tons of money. Average salaries for the lowest rank, Assistant Professor, is in the mid-$60k.

The other personnel includes all of the other jobs required to make a university run, from administration through maintenance. Surprisingly, most football programs are profit centers for the school.

As for me, I received a 33% raise when I left academia for the private sector.

Pickup_man

> ZHP Sparky, the 5th

Pickup_man

> ZHP Sparky, the 5th

02/26/2019 at 17:56 |

|

We started on the loan forgiveness path for a while, but after 2-3 years of making the minimum payment my wife got enough raises to no longer qualify for forgiveness. Great that sheís been getting raises and that we can afford the payments fairly easily, but it would have been nice to know that sooner and gotten more ahead on the interest.

Agreed on the 529, have a 4 month old at home, gotta start looking into that.†

Spanfeller is a twat

> Dru

Spanfeller is a twat

> Dru

02/26/2019 at 17:59 |

|

Yeah thatís smart.

I really grew hateful of the US higher education system back in highschool when our guidance counselors really sold it as something different.

I rember that many of the most competitve students spent upwards of 500 dollars just on applications to Ivy League colleges just to find out that itís really hard to get in no matter your grades if A: your parents didnít go there first, B: want any sort of assistance as a foreigner. So none of them got in and they lost a semester cus the deadlines to apply to college here were over.

A friend of mine actually got into an Ivy college and she couldnít pay for it.... it was very painful for her.†

I also remember that some for profit colleges came to campus which was diabolical. Like Hult which costs something like 40,000 dollars a year before any other expense. ITAM and ITESM here in Mexico City are better business schools, and cost a fraction of what Hult does... but no one told them.

fools....

Spanfeller is a twat

> TheRealBicycleBuck

Spanfeller is a twat

> TheRealBicycleBuck

02/26/2019 at 18:18 |

|

I still donít get it. Granted, I could count on my hands the amount of professors I know that make >60k a year. Iíd be surprised if the average prof earned more than 22k dollars a year.

But itís a different system, very few profs are actually encouraged to work here for a long time many of the 22k earners I say teach while

they get their doctorate degree. The biggest selling point for my college is that most of their teachers are only there part time.

What does that mean? Well, supposedly most teachers once you enter the more specialized areas of study actually have a job in the relevant field at the same time as you study with them.

So, in law for instance, very prominent lawyers go and teach 7th and 8th semester students and then poach them once they graduate, same goes for psychologists, architects, and journalists.

Since engineering is more time consuming we have more full time professors, but you still get to see some oddball who actually has a day job and you really need to focus on making a good impression because it could mean a job months before even graduating.

TheRealBicycleBuck

> Spanfeller is a twat

TheRealBicycleBuck

> Spanfeller is a twat

02/26/2019 at 18:26 |

|

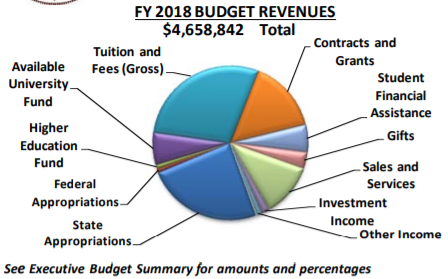

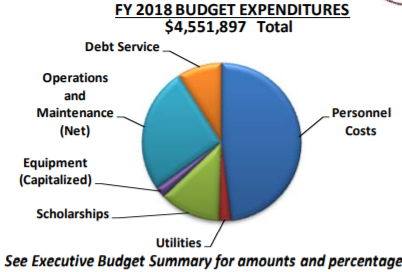

If youíre really interested, then pick a U.S. public university and google their budget. They all have to publish them somewhere. Hereís the breakdown for one of the state schools in Texas:

The biggest revenue producers are state appropriations and tuition/fees. The biggest expenditures are personnel costs followed by operations and maintenance. This school has a number of specialized facilities , so their O&M budget is probably higher than others.

ZHP Sparky, the 5th

> Pickup_man

ZHP Sparky, the 5th

> Pickup_man

02/26/2019 at 19:22 |

|

Yeah, our understanding was that if you are employed at an eligible non-profit or government organization and make consecutive payments for 10 years, you can have the remainder of your debt forgiven. I donít see the logic in telling people ďwell you paid off too much each monthĒ to qualify Ė meaning the amount they wouldíve had to forgive is lower? She very well couldíve taken much higher paying jobs in the private sector, but decided to do her research at teaching hospital/university labs instead for a lower salary knowing that student loan forgiveness eligibility was part of the perks Ė isnít that the entire schtick they sell you on for debt forgiveness in the first place?

Itís a complete mess Ė I know they made some federal funds available to help people out who were getting screwed over by this system, but at this point itís too much of a hassle for what is left of those loans after 10+ years of payments.

XJDano

> Dru

XJDano

> Dru

02/26/2019 at 22:30 |

|

On the flip side, I only attended 2 semesters of community college. So Iíve got other debt, but not like from the stories I hear. Iíve been working in construction for almost 20 years, and seen less than 5 ďkidsĒ who work with us during the summer stick with college and not only graduate, but get good jobs. One being an engineer at Nissan and one an eye Dr.

But there are others that work as a laborer after college because the degree isnít great or itís out dated.

As Mike Row states, tradesmen are needed, 4 year degrees arenít the best answer for everyone.

Iíve been to some nice places to work, but also some shit holes.

Iíve been lucky to be where I am making what I do, uneducated.†

Dr. Zoidberg - RIP Oppo

> Dru

Dr. Zoidberg - RIP Oppo

> Dru

02/26/2019 at 22:33 |

|

We have been dealing with student loans since the summer after I met my wife ó 13 years ago. After deferment of payments ended when my wife finished school, the monthly bill was ... I mean, I could have financed a new GS 350 F-Sport in 2015 with what we were paying.

Anyway... I set out a financial plan back in 2011 and Iíve been doing EVERYTHING in my power to not let it be a financial killer. Many sacrifices. Stuff like that. And ultimately itís been working as we did eventually buy a house, and so on. But you know: no frequent vacations, no financing vehicles, no new phones every 10 months, no sushi 3 times a week. Yadda, yadda.

Hope to pay off the rest of it soon, but I really hate dipping into savings... I also had the highest student debt amongst all my coworkers. And yet Iím probably the most financially responsible. BECAUSE I HAVE TO BE.

pip bip - choose Corrour

> Dru

pip bip - choose Corrour

> Dru

02/27/2019 at 03:29 |

|

thankfully no

never finished high school

Stef Schrader

> Dru

Stef Schrader

> Dru

02/27/2019 at 17:48 |

|

Yeah. Borrowed approximately one reasonably priced

condo

.

It never ends.

Iíll probably

die in debt.

Stef Schrader

> JeepJeremy

Stef Schrader

> JeepJeremy

02/27/2019 at 17:48 |

|

Y E P.

Stef Schrader

> Spanfeller is a twat

Stef Schrader

> Spanfeller is a twat

02/27/2019 at 17:51 |

|

Accurate.

Dru

> Stef Schrader

Dru

> Stef Schrader

02/28/2019 at 08:29 |

|

Oof.† Well they canít send a dead person into collections can they?

Highlander-Datsuns are Forever

> Dru

Highlander-Datsuns are Forever

> Dru

03/07/2019 at 09:55 |

|

I ended with about $15k in loans, paid it off in 5 years. It was a state school.